Ethereum is absorbing Bitcoins, but who is going to absorb Ethereum?

It’s been a positive start to 2021: Not only have Bitcoin, Ethereum and especially DeFi “blue chips” like Uniswap and Aave all surged in…

Bitcoin ROI Bands

Bitcoin ROI Bands

View Reddit by intothecryptoverse – View Source

The post Bitcoin ROI Bands appeared first on Crypto new media.

UPDATE: I coded a bot that buys Bitcoin when Elon Musk tweets about bitcoin and open sourced it

Earlier this week, I posted my first crypto trading bot project that was suggested by you in a previous post.

In a nutshell, the bot buys bitcoin whenever Elon Musk tweets about bitcoin. You guys came up with some great feedback on this, and many of you suggested there should be some form of sentiment analysis so that the bot won’t just buy when Elon says something negative about it.

So I looked for an API that would do the job and integrated it into the code.

The bot will now only buy Bitcoin when Elon Tweets, if the sentiment of his tweet is positive.

Article: [https://www.cryptomaton.org/2021/03/25/program-a-trading-bot-to-buy-bitcoin-when-musk-tweets-about-it-part-2/](https://www.cryptomaton.org/2021/03/25/program-a-trading-bot-to-buy-bitcoin-when-musk-tweets-about-it-part-2/)

GitHub Repo: [https://github.com/CyberPunkMetalHead/bitcoin-bot-buy-if-elon-tweets/tree/buy-crypto-if-elon-mentions-crypto-positively](https://github.com/CyberPunkMetalHead/bitcoin-bot-buy-if-elon-tweets/tree/buy-crypto-if-elon-mentions-crypto-positively)

Since this a community-driven project you guys get to name this bot!

View Reddit by CyberPunkMetalHead – View Source

The post UPDATE: I coded a bot that buys Bitcoin when Elon Musk tweets about bitcoin and open sourced it appeared first on Crypto new media.

New Zealand retirement fund reportedly allocates 5% to Bitcoin

KiwiSaver Growth Strategy, a $350 million retirement plan operated by New Zealand Wealth Funds Management, has reportedly allocated 5% of its assets to Bitcoin (BTC), underscoring the steady stream of institutional investors entering the digital asset space.

Bitcoin’s striking similarities to gold were cited as one of the biggest reasons for entering the trade, according to James Grigor, the chief investment officer at New Zealand Funds Management.

“If you are happy to invest in gold, you can’t really discount bitcoin,” he told Stuff, a New Zealand news agency, adding that BTC will be featured in more KiwiSaver products over the next five years.

Grigor explained that his firm purchased Bitcoin for the first time in October when it was valued at $10,000. To execute the trade, New Zealand Fund Management had to change its offer documents to allow for cryptocurrency investments.

Bitcoin’s price peaked north of $61,000 earlier this month, which would give KiwiSaver a 6x return in just five months. Although Bitcoin’s price has moderated over the past week, the pension fund is sitting on hefty BTC profits.

Grigor explained that KiwiSaver is “majority built up through traditional asset classes,” but noted that “other opportunities present themselves.” In the case of Bitcoin, it’s an asset class that could help “give people the best retirement they can get” through its aggressive compounding.

While hedge funds and family offices have been steadily embracing Bitcoin, pension funds are perhaps the slowest to adopt the digital asset class. The growth of institutional onramps could help accelerate the adoption narrative.

In the United States, Grayscale has noted that pension funds are already getting in on digital assets. “The sizes of allocations they are making are growing rapidly as well,” said Michael Sonnenshein, Grayscale’s CEO.

The post New Zealand retirement fund reportedly allocates 5% to Bitcoin appeared first on Crypto new media.

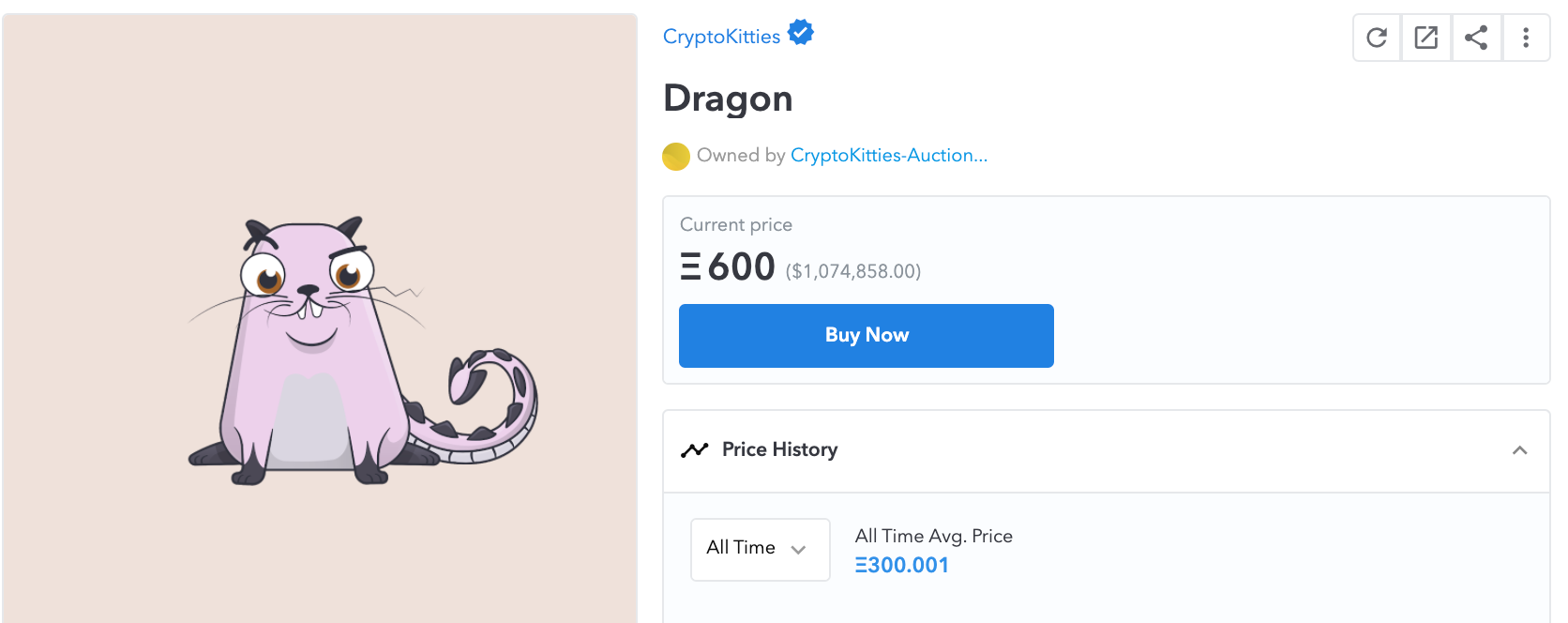

Quick intro to the NFT world

Many people first heard about NFT not so long ago, after a loud and controversial event in the art market. Beeple’s painting “Everydays…

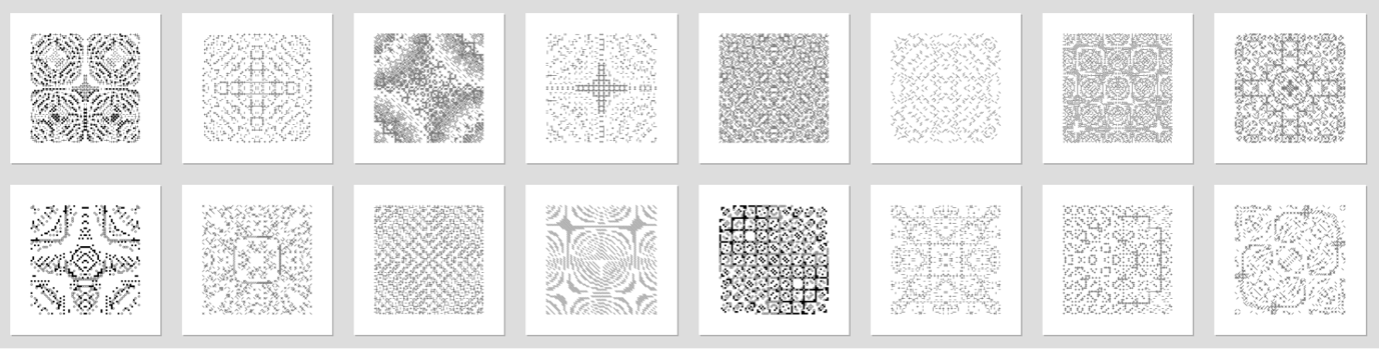

Autoglyphs first “on-chain” generative art on the Ethereum blockchain that can be a good long term…

Autoglyph is a highly optimized generative algorithm capable of creating billions of unique artworks, wrapped inside an ERC-721 interface.

IBM Ventures Further Into Crypto Custody

IBM Ventures Further Into Crypto Custody

View Reddit by w_savage – View Source

The post IBM Ventures Further Into Crypto Custody appeared first on Crypto new media.

Crypto Sentiments Go Sour After Bitcoin Announcement from Tesla

Elon Musk stands as the CEO of Tesla, and gave out an announcement yesterday that crypto users will now be capable of buying Tesla products by way of Bitcoin payments The interesting part of this, however, was the effect it had on the crypto market, apparently. The world’s largest cryptocurrency took this news, which furthered the adoption of Bitcoin in general, and saw it fit to drop close to 5% in value within just 24 hours.

Bitcoin Goes Under $1 Trillion Market Cap

CoinMarketCap, the Binance-owned crypto data provider, published recent data that showed that Bitcoin saw its market cap drop under the $1 trillion range for the first time in a week. At the time of writing, the market cap for Bitcoin is $980 million, with the world’s crypto market cap standing somewhere around $1.63 trillion. Just yesterday, this same metric stood at $1.78 trillion.

The negative crypto sentiments didn’t stop at Bitcoin, however. The second-largest cryptocurrency out there, Ethereum, saw itself go under the $1,600 range for the first time in almost two weeks. As it stands now, Ethereum is trading at $1,585 apiece at the time of writing. The market cap for the space was recorded at shy of $180 billion, as well. Within the past seven days, Ethereum has managed to go down by a factor of 115%.

Good news Leading To Bad Markets

Yesterday, Elon Musk revealed to the world that Tesla products could now be purchased by way of Bitcoin. Tesla itself is no stranger to the asset, starting its own bull run after announcing a purchase of $1.5 billion in Bitcoin back in February of this year. Another key announcement made by Elon Musk is Tesla’s lack of plans to convert these Bitcoin holdings back into fiat.

General Positive Crypto Sentiments

At this point, everyone is aware of how vocal Musk is, and remains to be, about Bitcoin and the various other cryptocurrencies there are, voicing his many opinions on various social media platforms. An invitation-only audio-chat networking app, Clubhouse, allowed Musk to have a conversation about how Bitcoin stands at the cusp of mass adoption within the world at large.

Throughout these last 2 months, however, Elon Musk saw an overall dip when it comes to his wealth thanks to Bitcoin price activity. Tesla, Musk’s company, is trading at close to #630 a share, 25% less than what it was just seven days prior, when it was $850 and held an $800 billion market cap.

Time will tell how the crypto markets will fair in the future, but some institutions had probably declared this event a “healthy correction” already. Many analysts predict that Bitcoin will only increase in value, and time will tell whether that sentiment is valid or not, as well.

The post Crypto Sentiments Go Sour After Bitcoin Announcement from Tesla appeared first on Crypto new media.