Bitcoin regains $50,000 as crypto market creeps above $2 trillion

Bitcoin pumped above $50,000 last night as the broader crypto market regained a $2 trillion valuation, data from multiple sources showed.

Such figures were last seen in May earlier this year before a brief two-month correction across the market. Some altcoins even fell as much as -85% from their May highs, but have since crept upwards as euphoria continues to brew around the crypto market.

Bitcoin breaks $50,000

Bitcoin trades above its 34-period exponential moving average (EMA)—a tool used by traders to determine market strength and trend by calculating historic asset prices—at press time, implying a bull trend is in place since the $32,000 price level.

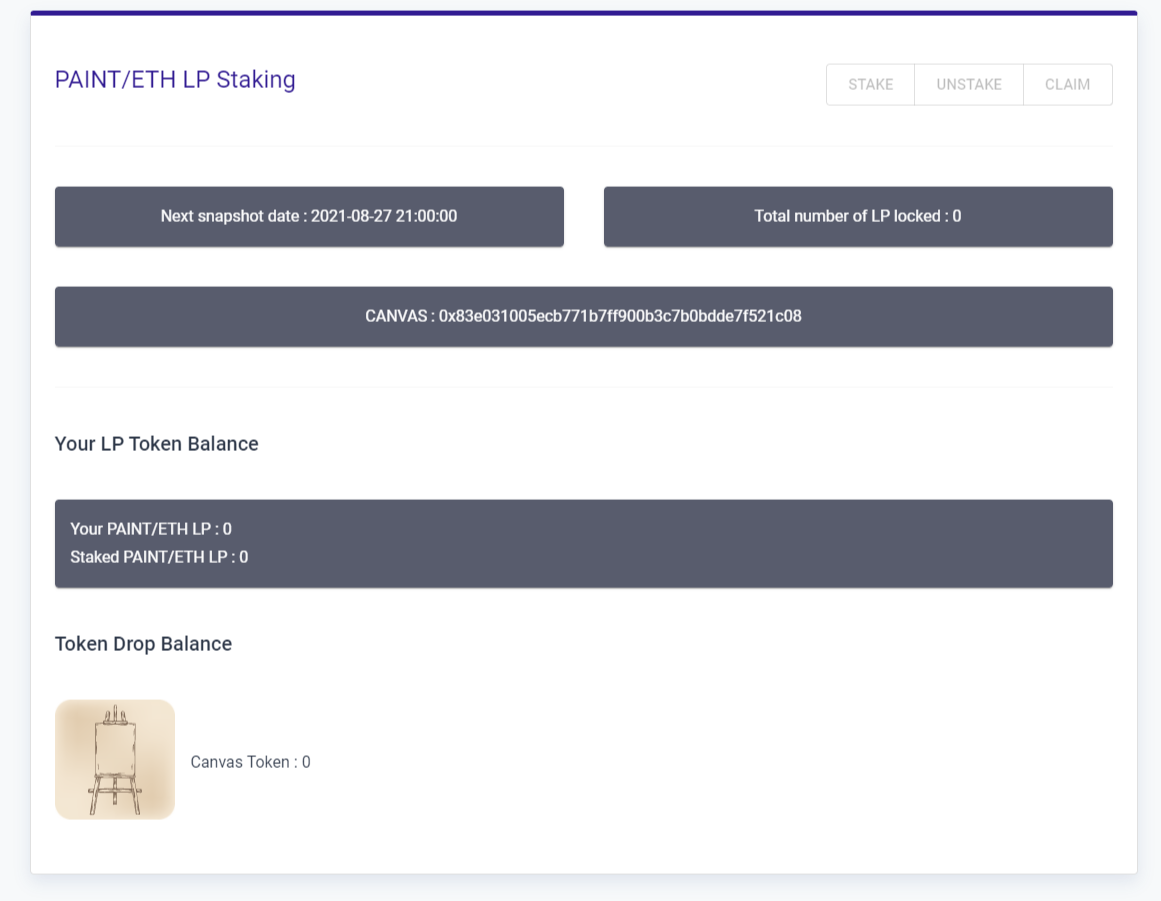

It, however, saw resistance at the $50,000 level. Further resistance levels, as the below image shows, are at the $58,000 price level and at upwards of $60,000.

Ethereum, the world’s second-largest asset by market cap, shows a similar market structure. ETH trades above the 34-period EMA, continuing its uptrend since the $1,900 price level. Resistance, however, exists at the $3,300 level at press time, with further resistance zones at $3,500, $3,900, and $4,300.

What are alts doing?

Other top cryptocurrencies have continued to post big gains in the past week. Binance Coin (BNB), which powers the Binance Smart Chain, Binance Chain, and can be used on crypto exchange Binance, rose 16% in the past week buoyed by higher demand for BNB on the smart contract-ready Binance Smart Chain.

Polkadot, the decentralized Web 3.0 services platform, rose 21% in the past week as traders sought investments on Layer-1 ecosystems outside of Ethereum.

Avalanche (AVAX), Cosmos (ATOM), and Fantom (FTM), also posted gains of 140%, 40%, and 62% respectively, with regional favorites ICON and Terra also rising 25% and 100% each.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.

The post Bitcoin regains $50,000 as crypto market creeps above $2 trillion appeared first on Crypto new media.